THE DEAD ZONE [v5] by @DavidTech 🧠 by @DaviddTech 🤖 [e0cba95d]

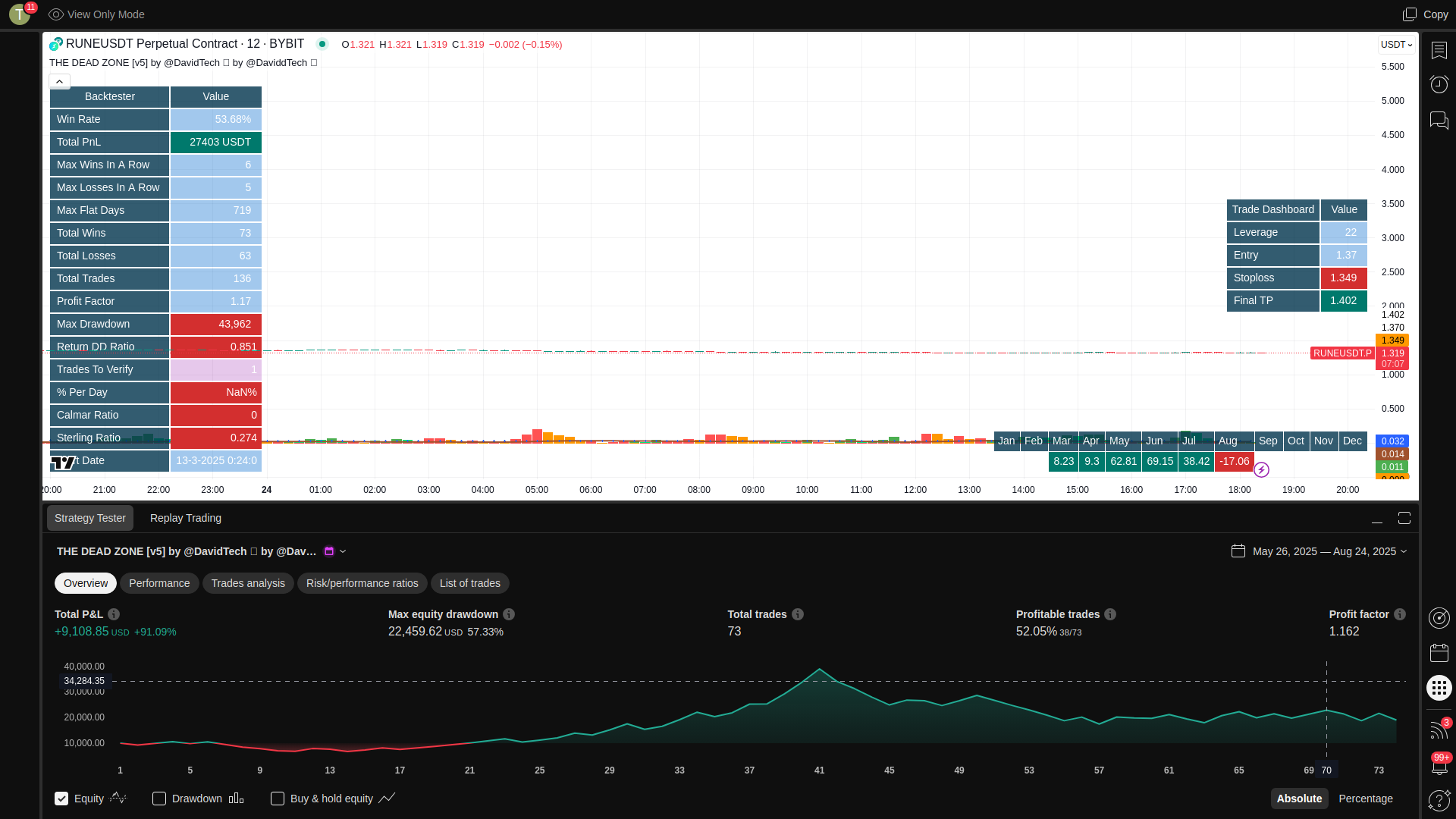

🛡️ DEAD ZONE RUNE 12MIN

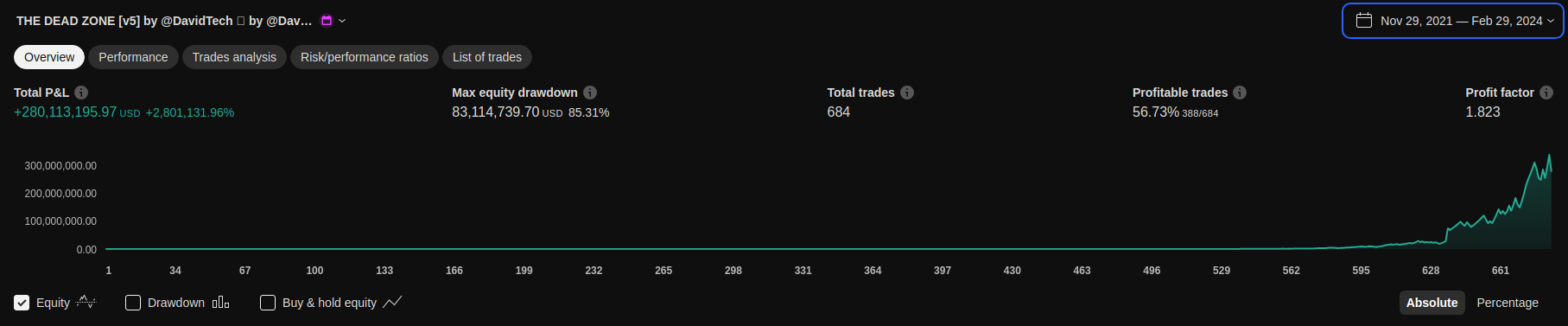

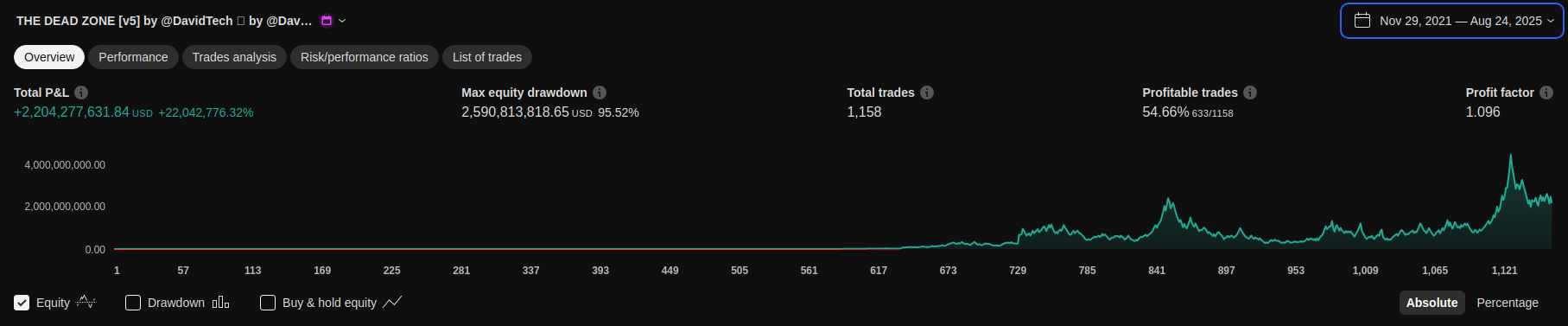

Performance Overview

Equity Curve Analysis

Performance comparison between backtest and live trading results

Strategy Analysis & Data

Comprehensive performance metrics and detailed analysis

Performance Metrics

Detailed trading performance analysis and key metrics

Trades per Day

Key Performance Metrics

- First Traded Date: 2021-12-03 17:12:00

- Sharpe Ratio: 0.50

- Sortino Ratio: 3.35

- Calmar: -15.50

- Longest DD Days: 268.00

- Volatility: 176.02

- Skew: 4.57

- Kurtosis: 61.96

- Expected Daily: 1.38

- Expected Monthly: 33.43

- Expected Yearly: 3,083.82

- Kelly Criterion: 6.12

- Daily Value-at-Risk: -13.19

- Expected Shortfall (cVaR): -16.05

- Last Trade Date: 2025-08-23 04:24:00

- Max Consecutive Wins: 8

- Number Winning Trades 633

- Max Consecutive Losses: 8

- Number Losing Trades: 525

- Gain/Pain Ratio: -15.50

- Gain/Pain (1M): 1.13

- Payoff Ratio: 0.93

- Common Sense Ratio: 1.13

- Tail Ratio: 1.16

- Outlier Win Ratio: 6.58

- Outlier Loss Ratio: 4.31

- Recovery Factor: 0.00

- Ulcer Index: 0.39

- Serenity Index: 220,809.55

Trade Analysis

Individual trade breakdown and analysis

List of Trades

Key : Pink Background = Live Trades | Black Background = Backtest Trades

Monthly Profit & Loss

Monthly performance breakdown with profit/loss indicators

Standard Monthly Profit

This shows the total profits or losses of the strategy after closing a trade and the percentage gain or loss of the strategy over time.

| Year/Month | January | February | March | April | May | June | July | August | September | October | November | December |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 3.10% |

| 2022 | 34.14% | 161.05% | 75.11% | -126.11% | 58.26% | -15.14% | 155.56% | 49.36% | 7.89% | 21.25% | 6.68% | -12.48% |

| 2023 | 54.68% | 16.16% | 30.34% | 24.04% | 6.72% | -18.64% | -36.24% | 111.24% | 145.84% | 224.04% | 162.67% | 68.72% |

| 2024 | 256.39% | 87.49% | 44.19% | 190.92% | 4.59% | -34.48% | 25.80% | 142.02% | -63.20% | -33.78% | 12.90% | -48.55% |

| 2025 | 152.36% | Login to see results | Login to see results | Login to see results | Login to see results | Login to see results | Login to see results | Login to see results | 0.00% | 0.00% | 0.00% | 0.00% |

Live Trading Statistics

Real-time trading performance and statistics

Live Trades Stats

474

Number of Trades

599.63%

Cumulative Returns

51.69%

Win Rate

2024-02-29

🟠 Incubation started

🛡️

7 Days

-14.33%

30 Days

123.82%

60 Days

100.25%

90 Days

Strategy Audit & Screenshots

Visual verification of strategy performance with TradingView screenshots

| All USD | All % | Long USD | Long % | Short USD | Short % | |

|---|---|---|---|---|---|---|

| Open P&l | 0.0 | 0.0 | ||||

| Net Profit | 280113195.97 | 2801131.96 | 135102009.6 | 1351020.1 | 145011186.36 | 1450111.86 |

| Gross Profit | 620380247.5 | 6203802.47 | 369507162.32 | 3695071.62 | 250873085.17 | 2508730.85 |

| Gross Loss | 340267051.53 | 3402670.52 | 234405152.72 | 2344051.53 | 105861898.81 | 1058618.99 |

| Commission Paid | 44866944.58 | 22941705.73 | 21925238.85 | |||

| Buy & Hold Return | -3781.57 | -37.82 | ||||

| Max Equity Run-up | 383139234.43 | 100.0 | ||||

| Max Drawdown | 83114739.7 | 85.31 | ||||

| Max Contracts Held | 410608337.0 | 367238095.0 | 410608337.0 | |||

| Total Closed Trades | 684.0 | 329.0 | 355.0 | |||

| Total Open Trades | 0.0 | 0.0 | 0.0 | |||

| Number Winning Trades | 388.0 | 185.0 | 203.0 | |||

| Number Losing Trades | 296.0 | 144.0 | 152.0 | |||

| Percent Profitable | 56.73 | 56.23 | 57.18 | |||

| Avg P&l | 409522.22 | 0.35 | 410644.41 | 0.53 | 408482.22 | 0.18 |

| Avg Winning Trade | 1598918.16 | 1.78 | 1997336.01 | 2.29 | 1235828.01 | 1.32 |

| Avg Losing Trade | 1149550.85 | 1.54 | 1627813.56 | 1.73 | 696459.86 | 1.35 |

| Ratio Avg Win / Avg Loss | 1.391 | 1.227 | 1.774 | |||

| Largest Winning Trade | 46286915.52 | 45239981.75 | 46286915.52 | |||

| Largest Winning Trade Percent | 25.07 | 2.88 | 25.07 | |||

| Largest Losing Trade | 61577608.86 | 61577608.86 | 22998797.03 | |||

| Largest Losing Trade Percent | 7.55 | 4.36 | 7.55 | |||

| Avg # Bars In Trades | 15.0 | 21.0 | 9.0 | |||

| Avg # Bars In Winning Trades | 13.0 | 19.0 | 8.0 | |||

| Avg # Bars In Losing Trades | 16.0 | 23.0 | 10.0 | |||

| Sharpe Ratio | 0.581 | |||||

| Sortino Ratio | 4.873 | |||||

| Profit Factor | 1.823 | 1.576 | 2.37 | |||

| Margin Calls | 0.0 | 0.0 | 0.0 |

| All USD | All % | Long USD | Long % | Short USD | Short % | |

|---|---|---|---|---|---|---|

| Open P&l | 0.0 | 0.0 | ||||

| Net Profit | 2204277631.84 | 22042776.32 | 2024380967.0 | 20243809.67 | 179896664.84 | 1798966.65 |

| Gross Profit | 25089145140.64 | 250891451.41 | 15298933711.08 | 152989337.11 | 9790211429.56 | 97902114.3 |

| Gross Loss | 22884867508.8 | 228848675.09 | 13274552744.08 | 132745527.44 | 9610314764.72 | 96103147.65 |

| Commission Paid | 2351142655.18 | 1157554361.04 | 1193588294.14 | |||

| Buy & Hold Return | -8611.31 | -86.11 | ||||

| Max Equity Run-up | 4732421138.64 | 100.0 | ||||

| Max Drawdown | 2590813818.65 | 95.52 | ||||

| Max Contracts Held | 18792631894.0 | 18792631894.0 | 16873174135.0 | |||

| Total Closed Trades | 1158.0 | 554.0 | 604.0 | |||

| Total Open Trades | 0.0 | 0.0 | 0.0 | |||

| Number Winning Trades | 633.0 | 295.0 | 338.0 | |||

| Number Losing Trades | 525.0 | 259.0 | 266.0 | |||

| Percent Profitable | 54.66 | 53.25 | 55.96 | |||

| Avg P&l | 1903521.27 | 0.28 | 3654117.27 | 0.4 | 297842.16 | 0.18 |

| Avg Winning Trade | 39635300.38 | 1.8 | 51860792.24 | 2.28 | 28965122.57 | 1.38 |

| Avg Losing Trade | 43590223.83 | 1.55 | 51253099.4 | 1.75 | 36129002.87 | 1.34 |

| Ratio Avg Win / Avg Loss | 0.909 | 1.012 | 0.802 | |||

| Largest Winning Trade | 602434529.4 | 602434529.4 | 400060446.31 | |||

| Largest Winning Trade Percent | 25.07 | 3.79 | 25.07 | |||

| Largest Losing Trade | 568917087.36 | 568917087.36 | 349720873.94 | |||

| Largest Losing Trade Percent | 7.55 | 4.36 | 7.55 | |||

| Avg # Bars In Trades | 13.0 | 20.0 | 7.0 | |||

| Avg # Bars In Winning Trades | 13.0 | 19.0 | 7.0 | |||

| Avg # Bars In Losing Trades | 15.0 | 21.0 | 8.0 | |||

| Sharpe Ratio | 0.499 | |||||

| Sortino Ratio | 3.346 | |||||

| Profit Factor | 1.096 | 1.153 | 1.019 | |||

| Margin Calls | 0.0 | 0.0 | 0.0 |

TradingView Screenshots

Slide this way to reveal live trades

USE SLIDER TO REVEAL RESULTS

Slide this way to reveal backtest

Slide this way to reveal live trades

USE SLIDER TO REVEAL RESULTS

Slide this way to reveal backtest

⚪️ Other Backtest

AI Quantitative Analysis

Advanced AI-powered insights and strategy analysis

AI Quantitative Analyst

Advanced Markov Motor Analysis

Sophisticated analysis of strategy edge degradation, rolling metrics, and Markov chain properties